wecan comply

Blockchain Data Manager

Wecan Comply is a Blockchain Data Manager used daily by over 100 financial

institutions.

+100 institutional clients

What is Wecan Comply?

1

Data filled by client

Ownership and control of data are returned to its rightful owner.

2

Protect

Your data is secured in a digital vault, accessible only by you. Even Wecan cannot access it.

3

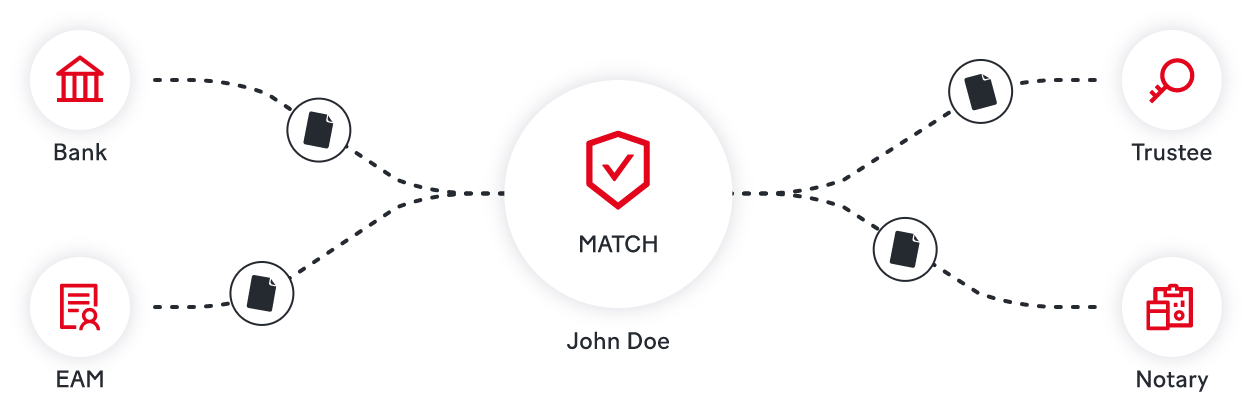

Store, Use & Exchange

Create a master version of your data and share or update it with all relevant counterparties. Alternatively, request data and use Wecan Comply for onboarding.

See what sets Wecan Comply apart

Standard

All data is standardized and structured to bring efficiency of sharing and request.

Avoid duplication

There is one golden copy of all important data for you business. This data can be used many times in different context and share to many counterparties.

Easy update

Share updated data or request an update in one click to all or a selection of counterparties.

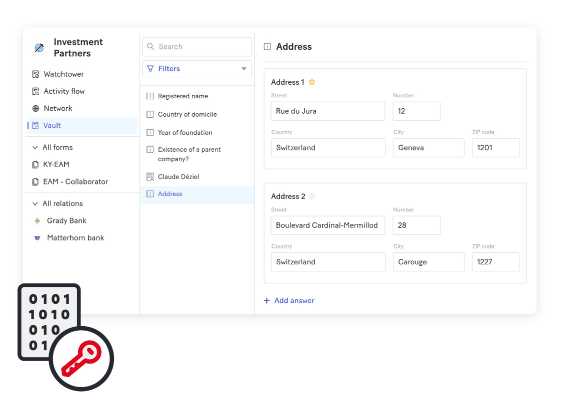

Secured

All your data is safe and encrypted. Storage is distributed across entities of the closed network made auditable by blockchain technology.

Compliance

Real time compliance status and task help you save time and reduce risk.

Main features

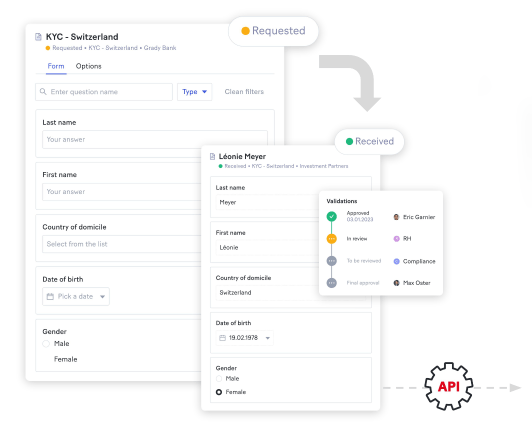

Data structured in forms

- Library of forms available (KYC, KYB, Employee, ..)

- Customisation by company

- Manage access by form

Data is secure & auditable

- Data stored in encrypted digital safe

- One safe by company (or region)

- Available on premise

- All modifications made auditable by private blockchain

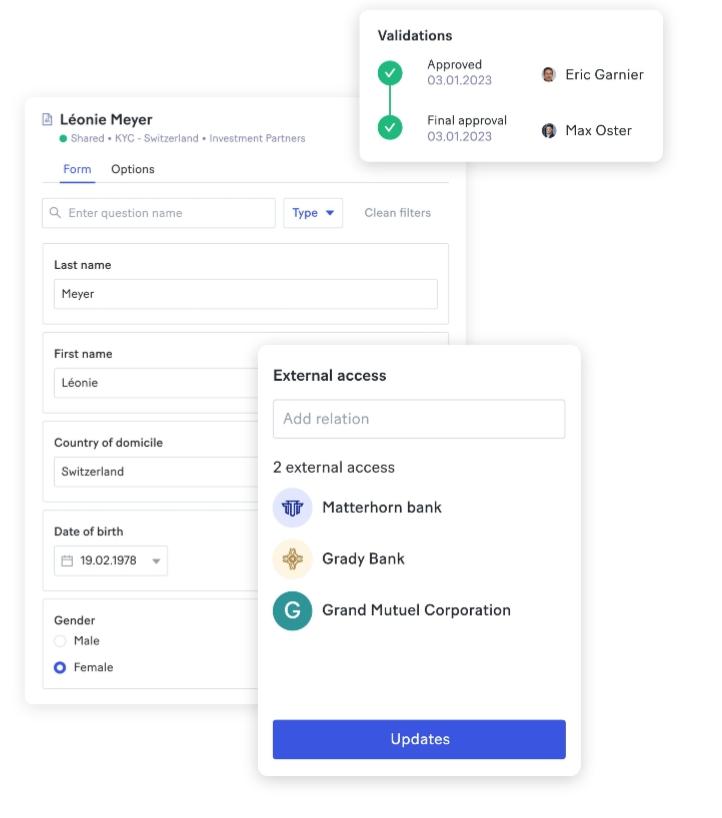

Efficient & easy sharing

- Share one set of data to multiple counterparties

- Update all your counterparties at once

- (Opt.) Internal validation before sharing

- Peer review of data

Streamline onboarding

- Request data to anyone

- Validate received data via custom workflow

- Connect your existing tools through API

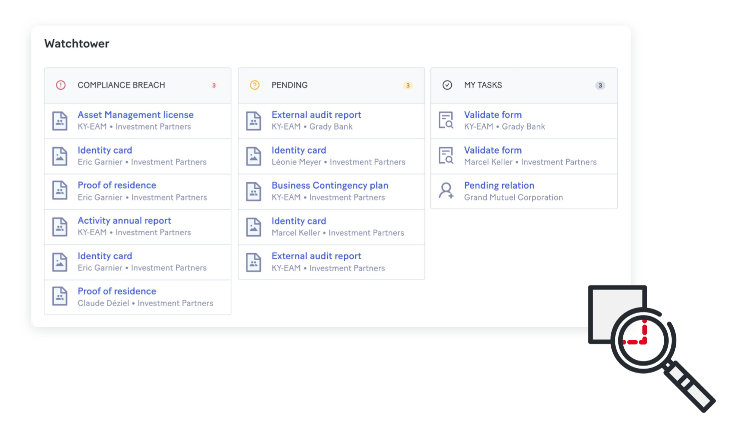

Real time compliance

- Compliance watchtower

- Anticipate or identify compliance breach

- Tasks for users

- Due date for data

Uses cases

Banks

- Signature cards

- Know your External Asset Manager

- Collaborators

External Asset Managers

- Signature cards

- Know your External Asset Manager

- Collaborators

Trustees

- Know your Trustee

- In-house company

- Directors

Looking to introduce a new business case?

Partner with us to create a fresh template and incorporate it into our library

Words from our partners

"We’ve been working with Wecan Group since its initial inception as a pilot partner for their EAM solution. Wecan Comply Platform enables us to be more efficient in our daily operations, freeing up commercial capacity to focus on our ambitious growth strategy. Collaborating with Wecan Group, a homegrown Swiss technology partner, clearly demonstrate our commitment to our Swiss intermediaries and our focus on remaining at the forefront of technology developments. "

Corentin Hegetschweiler

Head of EAM Geneva

"Wecan Comply will facilitate the daily life of our customers by reducing their operational work while allowing secure information sharing between stakeholders. "

Laurent Pellet

Limited Partner - Global Head of External Asset Managers

"As a private bank on a human scale, we are very close to our GFI partners and their needs, so we believe it is important to support them through a visionary digital solution that aims to optimise compliance processes via blockchain capabilities with very promising potential in our business. "

Maryline Stiegler

Head of the Independent Asset Managers Department (GFI)

"At Pleion we have been innovating for 40 years for our clients. It is obvious that new solutions like Wecan Comply are transforming our industry and it makes sense for us to be part of it. "

Patrick Humbert-Verri

COO - Risk Manager

"Wecan Comply's innovative, targeted and community-based digital platform will enable us to meet our regulatory requirements in a shorter time, to the benefit of the service provided to our customers. "

Laure Muir

CEO

"In the light of recent and ongoing regulatory changes, Pictet has identified an opportunity to digitize the onboarding and relationship management process with external asset managers (EAMs). Wecan Comply and its shareable standard for data collection ensure considerable efficiency gains for our EAMs. "

Cédric Haenni

COO Pictet Asset Services

"We want to offer our clients services that secure their data and their exchanges while respecting their privacy. The exclusivity behind our hotel or medical activities will be further strengthened with what we are going to set up with Wecan, and will enable our customers to be in an exclusive club on an international scale. "

Michel Reybier

Founder of La Reserve Group

"One of those quick wins! By using WecanComply, we rationalize our administrative duties, ensure our data is centralized, accurate - and safe. A straight forward solution for a significant gain in efficiencies, which illustrates how digitalization and blockchain can enhance our processes. "

Amélie Janssens de Bisthoven

Head of Business Intelligence

SUPPORT

Product resources

Booklet

Lorem ipsum dolor sit amet, consectetuer adipiscing elit. Aenean commodo ligula eget dolor. Aenean massa….

Starter Guide

Lorem ipsum dolor sit amet, consectetuer adipiscing elit. Aenean commodo ligula eget dolor. Aenean massa….

Onboard your team

Lorem ipsum dolor sit amet, consectetuer adipiscing elit. Aenean commodo ligula eget dolor. Aenean massa….

Latest news

Wecan Wins Prestigious “Best Regtech Solution Provider – Communications” Award at the 24th Banking Tech Awards

London, 30 November 2023 — Wecan Group, a leading innovator in the world of Regtech, is proud to announce its recent recognition as the “Best

Wecan Connect at La Réserve Geneva for client privacy and increased efficiency

La Réserve Geneva is rolling out the Wecan Connect technology to secure communications with its clients, propose exclusive offers and increase efficiency. Didier Bru, General

WeCan Group : Meilleure solution blockchain européenne aux WealthBriefing European Award (FR)

by Frédéric Bonelli Published in Forbes on July 13, 2023 (link) Le groupe WeCan a remporté le titre de « Meilleure Solution Blockchain » lors